Nvidia Stock Profit Calculator: Decoding Five Years of Potential Gains (and Losses)

The allure of easy riches is potent. Online NVIDIA stock profit calculators flash impressive figures—sometimes exceeding 1600% return in five years. But before you rush to invest based solely on these projections, consider this: past performance is never a guarantee of future success. These calculators provide a tempting glimpse into what could have been, not a prediction of what will be. For another perspective on stock prediction, check out this Jasmy calculator.

The Allure of Easy Riches: Past Performance Is Not Predictive

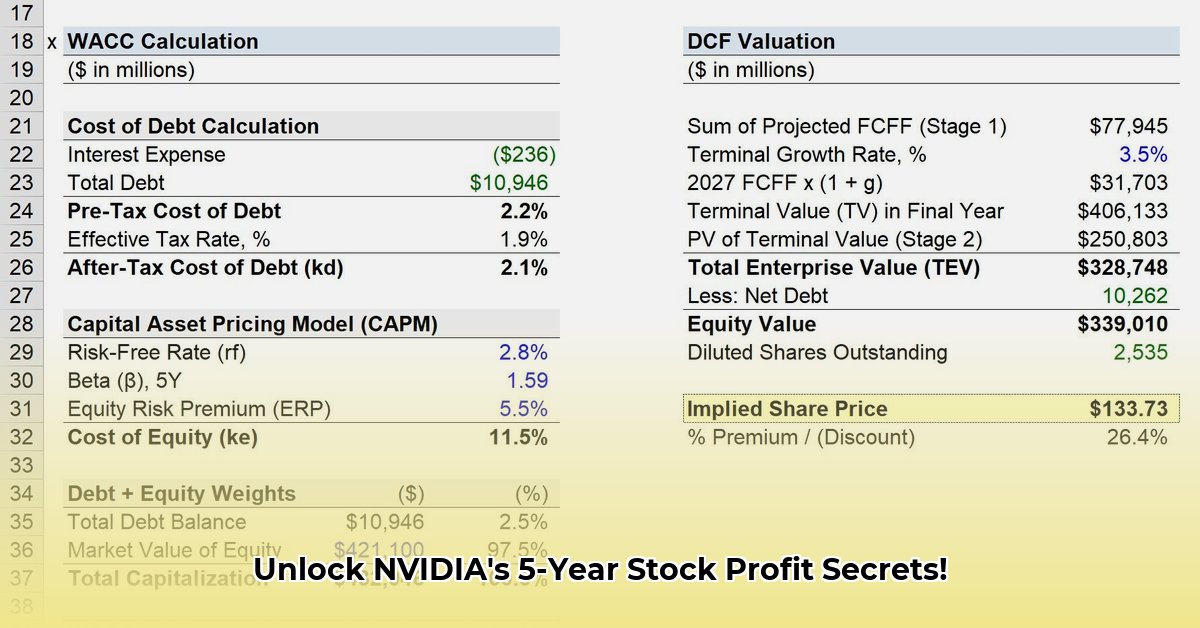

While the numbers generated by these calculators can be undeniably exciting, they present a significant risk: overreliance on past data. One such tool, Finlo's calculator 1, showcases stunning potential returns—a 1689.53% increase on a $1000 investment over five years. However, "Such impressive returns don't ensure similar success in the future," cautions Dr. Anya Sharma, Professor of Finance at the University of California, Berkeley. "Market conditions shift; technological disruption is constant; these calculators offer a limited perspective."

Isn't it tempting to envision a quick path to financial freedom based on such numbers? The reality, however, is far more nuanced. These tools are snapshots of a past possibility, not a forecast of the future. They lack the context necessary for informed decision-making.

Looking Beyond the Numbers: The Importance of Contextual Analysis

While an NVIDIA stock profit calculator offers a quick view, it omits crucial context. How did NVIDIA's performance compare to the broader market during the same period? Did other tech stocks or the S&P 500 exhibit similar growth? Comparing it to a single other company, as some calculators do, provides an insufficiently broad perspective. We need a wider lens to accurately assess potential returns. "Think of it like judging a single tree's growth without examining the entire forest," explains Mr. David Chen, Senior Portfolio Manager at Vanguard. A holistic analysis considers market trends, regulatory changes, and competitive dynamics.

Riding the Rollercoaster: Risk and Reward are Inseparable

Investing entails inherent risk. Economic downturns, geopolitical events, technological disruptions—all can significantly impact stock performance. "No calculator can predict the unpredictable," states Ms. Sarah Miller, Chief Investment Strategist at Fidelity Investments. "These tools are valuable for exploring possibilities but shouldn't replace thorough research and a robust risk assessment."

Key Takeaways:

- Past performance is not an indicator of future results: While Finlo's data 1 reveals a significant past return for NVIDIA, this doesn’t predict future success.

- Context is crucial: Analyzing NVIDIA’s performance relative to the overall market and competing companies provides a more accurate picture.

- Risk assessment is paramount: Understand the inherent volatility of the stock market and diversify your portfolio to mitigate losses.